Built for Analysts Who Actually Work with Numbers

We started klymoraex in 2019 because we kept seeing the same problem. Corporate finance training was either too theoretical or way too basic. Analysts needed something in between—real frameworks they could apply Monday morning.

The Problem Was Pretty Clear

Back in 2019, Jasper was running financial planning at a mid-sized tech company in Sydney. He'd hire bright analysts with solid degrees, but they'd struggle with practical valuation work. Not because they weren't smart—they just hadn't learned how real companies actually build financial models.

University courses taught them theory. Online platforms showed them software tricks. But nobody was teaching the messy middle ground: how do you structure a forecast when half your assumptions are guesses? What do you do when leadership changes strategy mid-year?

So we built something different. Not another certification program that looks good on paper. Just practical training that helps analysts get better at the actual work they do every day. And apparently, that's what people were looking for.

How We Actually Teach This Stuff

Our programs focus on skills you'll use repeatedly. No fluff about being a "finance rockstar"—just clear frameworks for common situations analysts face.

Real Company Scenarios

We use actual case studies from Australian businesses. Not simplified textbook examples. You'll work through acquisitions that went sideways, forecasts that needed emergency revisions, and board presentations where the numbers told an uncomfortable story.

Small Group Format

Maximum 18 people per session. You're not watching someone click through Excel on a giant screen. You're building models yourself while instructors walk around and catch mistakes before they become habits.

Industry Context Matters

Healthcare finance is different from retail, which is different from manufacturing. We don't pretend one approach works everywhere. Sessions adapt based on what sectors participants actually work in.

Follow-Up Support

Training doesn't end when the session does. Participants get access to our working group where they can ask questions about specific situations they're facing. Sometimes the best learning happens when you're stuck on a real problem at 3pm on a Thursday.

People Who've Done This Work

Our instructors aren't career trainers. They're finance professionals who still do client work and consulting projects. They teach because they remember struggling with this stuff themselves.

Which means when someone asks a question about handling a tricky board presentation or explaining a valuation gap, they're sharing what actually worked, not what a textbook says should work.

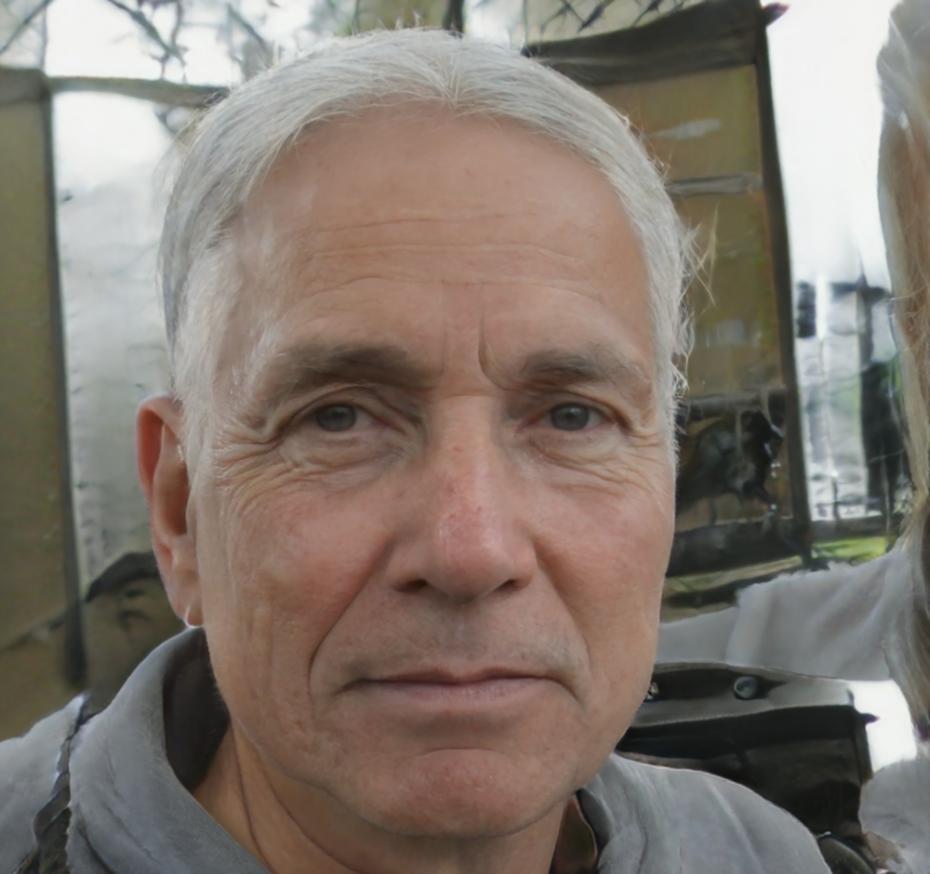

Jasper Thistlewaite

Managing Director

Spent 12 years in corporate FP&A roles before starting klymoraex. Still consults with companies on financial planning strategy, which keeps his teaching grounded in current practice rather than outdated methods.

Ronan Fitzwilliam

Head of Financial Strategy

Previously led valuation teams at two Big Four firms. Joined klymoraex in 2021 after getting tired of training programs that didn't prepare analysts for actual client work. Specializes in M&A financial modeling.

Strategic Planning

Building financial plans that survive contact with reality. How to forecast when you don't have perfect information, which is basically always.

Valuation Methods

DCF, comparable company analysis, precedent transactions. When to use each approach and how to defend your assumptions when challenged.

Financial Modeling

Building models that other people can understand and update. Structure, documentation, and error-checking techniques that actually work.

Next Program Starts September 2025

Our autumn intake opens for registration in June. Sessions run Tuesday and Thursday evenings in Sydney, with a weekend intensive for participants from other states. If you want details about topics covered and session structure, get in touch.

Get Program Information